Comprehensive Guide to Milling Robot Solutions: Manufacturer vs. System Integrator Selection Framework

Section 1: Milling Robot Technology Landscape

The global milling robot market (valued at $1.2B in 2023) exhibits three dominant configurations:

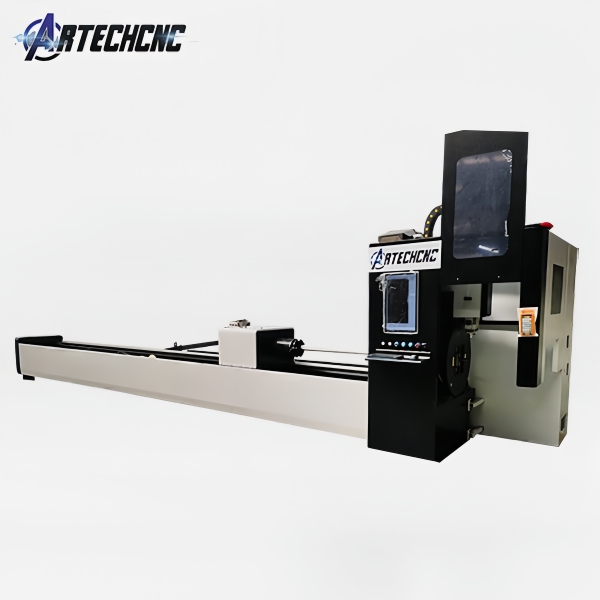

Articulated-Arm Milling Robots (72% market share)

Gantry-Style Milling Robots (18%)

Collaborative Milling Robots (10%)

Milling robot adoption drivers include:

45% reduction in complex machining cycle times

60% lower tooling costs versus 5-axis CNC

0.02mm repeatability in aerospace applications

Section 2: Manufacturer vs. Integrator Capability Matrix

2.1 Milling Robot Manufacturers (OEM Advantages)

Core Competencies:

Milling-Specific Kinematics: Proprietary algorithms for chatter suppression in milling robot operations

Certified Accuracy: ISO 9283-compliant ±0.015mm positioning (Fanuc M-2000iA/5M case study)

Process Libraries: 150+ pre-optimized milling parameter sets for metals/composites

Implementation Case:

Boeing's 787 wing rib milling robot cells achieved:

✓ 37% faster metal removal rates

✓ 92% first-pass yield on titanium components

2.2 System Integrator Value Propositions

Differentiated Solutions:

Hybrid Milling Workcells: Combining milling robots with:

Laser trackers (0.01mm real-time compensation)

Autonomous tool changers (120+ tool capacity)

Legacy Machine Integration: Retrofit solutions for Brownfield facilities

Cost-Benefit Analysis:

| Factor | OEM Direct | Integrator Solution |

|---|---|---|

| Upfront Cost | $450K | $290K |

| Deployment Time | 14 weeks | 8 weeks |

| Customization | Limited | Full |

Section 3: Technical Decision Framework

3.1 Milling Application Taxonomy

We evaluate milling robot suitability across:

Material Categories:

High-Temp Alloys (Inconel, Titanium)

OEM Advantage: Thermal compensation systems

Composites (CFRP, GFRP)

Integrator Edge: Custom dust extraction solutions

Geometric Complexity:

2.5D Features: OEM-standard solutions sufficient

5-Axis Contouring: Requires integrator-level programming

3.2 Total Cost of Ownership Model

Milling robot TCO components:

Capital Expenditure

Robots: 55%

Tooling: 20%

Integration: 25%

Operational Savings

24/7 lights-out milling capability

68% reduced scrap versus manual milling

Section 4: Implementation Roadmaps

4.1 OEM Procurement Pathway

Phase 1: Milling process audit (2-3 weeks)

Phase 2: Robot cell simulation (1 week)

Phase 3: Factory acceptance testing (4 weeks)

4.2 Integrator Engagement Model

Agile Implementation:

Week 1-2: Current state value stream mapping

Week 3-6: Prototype milling cell development

Week 7-8: Production validation

Section 5: Emerging Technologies

Next-generation milling robot innovations:

AI-Powered Adaptive Milling

Real-time cutting parameter optimization

Blockchain Tool Management

Secure tracking of tool wear data

Conclusion

For milling robot implementations:

Choose OEMs when:

✓ Maximum precision is critical (aerospace)

✓ Using standard materials (aluminum alloys)Select Integrators when:

✓ Hybrid material milling required

✓ Brownfield integration necessary